The Greatest Guide To Clark Wealth Partners

Wiki Article

The Of Clark Wealth Partners

Table of ContentsThe 8-Minute Rule for Clark Wealth PartnersClark Wealth Partners Can Be Fun For AnyoneThe Facts About Clark Wealth Partners UncoveredNot known Details About Clark Wealth Partners Getting My Clark Wealth Partners To WorkAbout Clark Wealth PartnersClark Wealth Partners Fundamentals Explained

The globe of finance is a difficult one. The FINRA Foundation's National Capability Research, for instance, just recently located that virtually two-thirds of Americans were not able to pass a basic, five-question economic proficiency examination that quizzed individuals on subjects such as passion, financial debt, and other relatively fundamental concepts. It's little wonder, after that, that we typically see headlines lamenting the poor state of many Americans' funds (financial advisors Ofallon illinois).Along with handling their existing customers, financial consultants will usually spend a reasonable amount of time each week conference with possible customers and marketing their solutions to maintain and grow their organization. For those taking into consideration ending up being a financial expert, it is necessary to think about the average income and job stability for those functioning in the field.

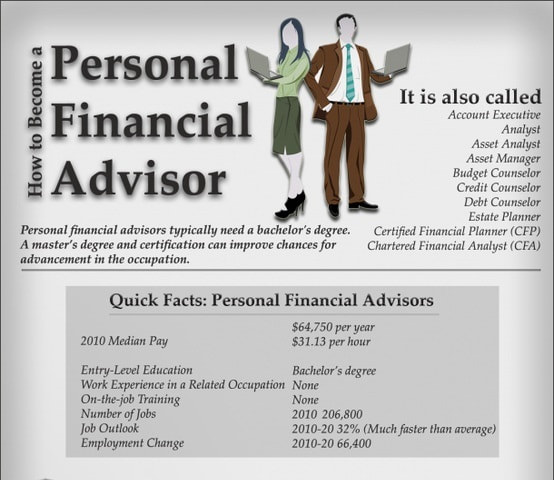

Courses in taxes, estate planning, investments, and threat administration can be useful for pupils on this path. Depending upon your unique career objectives, you might likewise need to make details licenses to fulfill certain customers' needs, such as purchasing and offering supplies, bonds, and insurance coverage. It can also be handy to make a certification such as a Certified Economic Coordinator (CFP), Chartered Financial Expert (CFA), or Personal Financial Specialist (PFS).

The Of Clark Wealth Partners

Lots of people choose to obtain aid by making use of the solutions of a monetary expert. What that appears like can be a number of points, and can vary depending upon your age and phase of life. Before you do anything, study is key. Some people fret that they require a certain amount of cash to invest before they can get help from a professional.

Rumored Buzz on Clark Wealth Partners

If you have not had any kind of experience with a monetary advisor, below's what to expect: They'll begin by offering a comprehensive evaluation of where you stand with your properties, liabilities and whether you're satisfying criteria contrasted to your peers for financial savings and retired life. They'll examine brief- and lasting goals. What's helpful regarding this step is that it is individualized for you.You're young and functioning full-time, have an auto or 2 and there are pupil financings to pay off. Here are some possible concepts to assist: Establish excellent cost savings behaviors, settle debt, established standard goals. Settle student finances. Depending on your occupation, you may certify to have part of your school funding waived.

The 10-Minute Rule for Clark Wealth Partners

You can discuss the following finest time for follow-up. Financial consultants generally have different rates of rates.

You're looking ahead to your retirement and assisting your youngsters with higher education expenses. An economic advisor can provide advice for those situations and even more.

Unknown Facts About Clark Wealth Partners

Set up routine check-ins with your planner to tweak your plan as needed. Balancing cost savings for retired life and college expenses for your kids can be tricky.Thinking of when you can retire and what post-retirement years could appear like can produce concerns regarding whether your retired life financial savings this hyperlink are in line with your post-work plans, or if you have actually conserved enough to leave a heritage. Assist your financial professional comprehend your approach to cash. If you are much more conservative with saving (and potential loss), their pointers should respond to your concerns and concerns.

Fascination About Clark Wealth Partners

Intending for wellness care is one of the big unknowns in retirement, and a financial professional can detail alternatives and suggest whether additional insurance coverage as protection may be helpful. Prior to you start, try to get comfy with the idea of sharing your whole financial picture with a specialist.Offering your professional a complete photo can help them create a strategy that's prioritized to all components of your monetary condition, particularly as you're rapid approaching your post-work years. If your funds are basic and you have a love for doing it on your own, you might be great on your very own.

A financial expert is not just for the super-rich; anyone encountering major life shifts, nearing retirement, or sensation overwhelmed by economic decisions might gain from expert guidance. This post checks out the role of financial consultants, when you may need to consult one, and essential factors to consider for selecting - https://clark-wealth-partners.jimdosite.com/. A monetary consultant is a skilled expert that aids clients handle their finances and make notified choices that line up with their life goals

The 45-Second Trick For Clark Wealth Partners

In contrast, commission-based advisors gain revenue with the monetary products they market, which might influence their suggestions. Whether it is marriage, divorce, the birth of a kid, career changes, or the loss of an enjoyed one, these occasions have distinct economic implications, frequently requiring prompt choices that can have long lasting results.

Report this wiki page